Finance and investing early are two issues which have come up on The HIM & HER Present lots currently. From the newest episode with the founding father of YNAB to the episode with Katie Music of Area Cash, making your {dollars} give you the results you want is extra essential than ever.

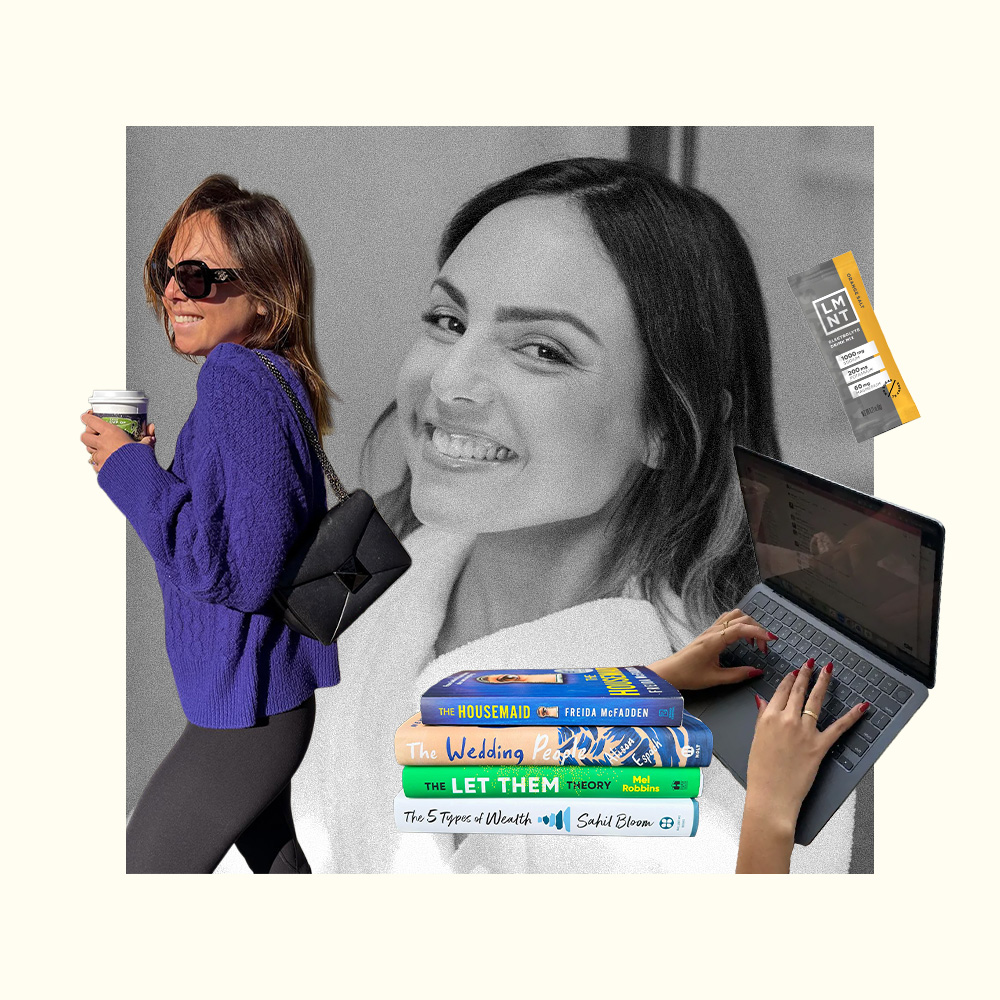

At present Nicole Bruno, aka @nobread is right here to inform us how she received into Angel Investing by means of her celiac illness analysis. On this publish you’ll be taught what it takes to be an angel investor, the best way to make investments with Nicole by means of her angel fund, and the best way to determine up and coming developments that could possibly be the following massive factor.

Let’s welcome Nicole to the weblog.

+++

Hello! I’m so grateful to The Skinny Confidential group for having me. My identify is Nicole Bruno and I’m the influencer behind @nobread. I’m a former finance nerd whose Celiac Illness analysis opened me as much as the wild world of better-for-you meals and wellness. After I was 19 and first recognized with Celiac Illness, the gluten-free objects in a grocery retailer consisted primarily of rice truffles and potato chips, and gluten-free manufacturers had been solely a small a part of one aisle… if that!

As gluten-free turned extra prevalent, folks began asking me for my suggestions. I assumed, “let me do the hard-work for you.” And alas, NOBREAD started.

I caught the influencer wave in 2014 whereas working at my Fairness Gross sales Job at J.P. Morgan, and left my unbelievable profession to observe my ardour mission weblog full-time. That leap of religion paid off in each manner possible. My finance ardour and wellness ardour ultimately remarried, and I began my Angel Funding fund in 2020, investing within the subsequent technology of modern meals and wellness corporations. Investing has introduced me extra success than I might have ever dreamed of.

At present, I’m an investor in probably the most unbelievable corporations, i.e. Olipop, Three Needs, De Soi, Partake Cookies, Poppi and over a dozen extra.

Out of the entire jobs I’ve, inspiring ladies to speculate and make their cash work for them is the job I’m most enthusiastic about. So right now, I wish to train you my methods and enable you to make your first funding.

Do you wish to be an Angel Investor? Listed here are 4 tricks to set you up for fulfillment.

So as to make investments it’s a must to be an accredited investor.

There is no such thing as a “angel investor” or “accredited investor” check it’s essential take, however it’s essential meet this standards:

+ Have an annual revenue of at the least $200,000, or $300,000 if mixed with a partner’s revenue.

+ Have a web value of $1 million or extra—both individually or along with a partner.

+ Holds a sound Collection 7, 65 or 82 license.

Networking for deal movement.

I’m usually requested how I’ve entry to a lot deal movement and the reply is that I’m an enormous networker. If there’s an occasion, I’m at it. If there’s a convention hosted by a distinguished investor, I’m there and asking them a query. And if there’s a model or firm I really like, I DM/Linkedin the group and allow them to know.

Angel Investing is tremendous entrepreneurial, and constructing a community of fellow angel buyers and passionate entrepreneurs goes a good distance, particularly with regard to getting deal movement. I view the folks in my community as my colleagues, and we’re all desirous to share alternatives with one another. Construct your community, and the offers will come.

Don’t over make investments

Angel investing is enjoyable, however tremendous dangerous. Relying on how early on you put money into a model, will probably be 5-10 years earlier than an exit! That’s, in case you’re fortunate sufficient to have an exit. You might be enjoying the lengthy sport, so it is very important solely ever make investments an quantity you might be prepared to lose, or prepared to not have entry to for an extended time frame.

Outline your ‘why.’

Why do you wish to make investments on this firm? There are a ton of unbelievable corporations on the market, however what’s it about this one which makes it a great funding? Bear in mind, simply because an organization is “cool” or “tastes good” isn’t motive sufficient to speculate and put your cash on the road. What’s the founder like? Is the corporate worthwhile or on the trail to profitability? What class is the corporate disrupting? What are the developments of proper now?

Talking of developments. Listed here are the three developments I’ve my eye on proper now:

The Return of Dairy

Vegan and dairy-free is out, uncooked dairy and entire meals are again. When the world found you may make milk and butter from nuts, the dairy free motion skyrocketed— whether or not you needed to be dairy-free or not. All of the sudden, dairy-free something was deemed the “more healthy” various. Sadly, many popularized dairy-free merchandise additionally want lots of gums and components to make the product resemble their unique.

This introduced dairy again into the limelight, and over the course of 2023/2024, the ability of dairy — in its purest kind— swung again into motion. All of the sudden, everybody who can is having dairy once more! I’ve to be dairy-free attributable to allergy, however it’s essential as an investor that I acknowledge the place the market is transferring, even when I can’t indulge myself.

Fertility

Let’s face it. {Couples} are getting pregnant later. We aren’t our dad and mom and grandparents technology. However the capability to get pregnant later and the specified age to get pregnant has turn into inverse. The feminine fertility house has seen some main motion, with the introduction of corporations like Perelel, We Natal, and Wanted, however the male fertility house isn’t completely there but. I predict we’ll see much more motion out of the 2 classes over the following few years, and it’s a development that’s right here to remain.

Seed-Oil Free/Dye Free

Seed Oil free is the buzzy tagline of this decade, however it hasn’t come with out some controversy. Finally, the one perception all consultants appear to agree on is that seed oils are used excessively, and when mixed with meals that even have synthetic components or preservatives, they need to be averted. My latest funding is on this house and I can’t wait to share it quickly.

I hope this publish has left you impressed to make your cash give you the results you want, and exit and discover your first funding. I publish the entire newest enterprise capital and investing information each week on my Substack, and provide alternatives to speculate with me by means of my angel fund, NB VC.

~ Nicole

+++

Have you ever invested in an trade that you just’re additionally enthusiastic about? Tell us under. In order for you extra on investing and finance, remember to take a look at:

+ Suggestions for Monetary Freedom

+ The Do’s and Don’ts of Managing Finance

+ The Advantages of a Monetary Plan

+ Michael’s Solo Episode on Finance

x, The Skinny Confidential group.

+ Cash saving ideas for {couples} right here.

++ Find out how to domesticate lasting success with Tony Robbins.